But that doesn’t necessarily mean that every year the asset returned exactly 10%. A mutual fund with a long track record of consistent returns will display a low standard deviation. A growth-oriented or emerging market fund is likely to have greater volatility and will have a higher standard deviation. In other words, the Sharpe ratio aims to determine how much additional return an investor can receive with the additional volatility on account of holding riskier assets.

Is Virtus Duff & Phelps Water A (AWTAX) a Strong Mutual Fund Pick … – Nasdaq

Is Virtus Duff & Phelps Water A (AWTAX) a Strong Mutual Fund Pick ….

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

Come to this of it, I have just explained in greater detail this strategy which helped me increase my returns by 9% with no increase of mutual fund risk in my portfolio. This is done by replacing a good portion of actively managed funds with index funds when both these type of funds displayed similar risk behaviour. The 9% improvement comes on account of lower expenses in index funds which gives me a better alpha.

Example of Standard Deviation Measurement

The risk-free return is the maximum return you can generate without taking any risk. By risk I mean – market risk, credit risk, interest rate risk, and unsystematic risk. If the beta was 0.6 or 0.65, the fund is less risk or less volatile compared to its benchmark.

Some investors might not be comfortable investing in assets that have such high volatility, even if the potential reward is greater. Retirees, for example, might prefer more reliable returns to fund their retirement lifestyle, rather than potentially navigating periods where assets return far less than average. Due to its consistent mathematical properties, 68% of the values in any data set lie within one standard deviation of the mean, and 95% lie within two standard deviations of the mean. Alternatively, you can estimate with 95% certainty that annual returns do not exceed the range created within two standard deviations of the mean.

What is Standard Deviation in Mutual Funds?

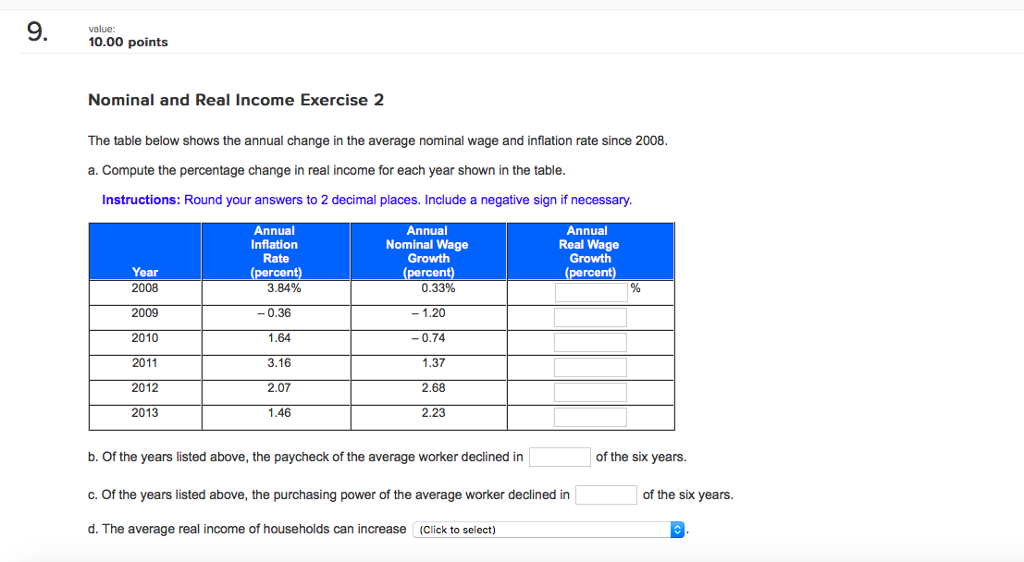

However, you must consider the fact that standard deviation also has some limitations as well. Suppose Arun has invested in a mutual fund with a standard deviation of 4% and average returns of 15%. Standard deviation is a statistical tool that provides information about a financial instrument’s underlying volatility or risk. This statistic provides information about the extent to which a mutual fund’s returns can deviate from the arithmetic mean of its annual returns. Economic factors such as interest rate changes can always affect the performance of a mutual fund.

While mutual funds are often less volatile than individual stocks, fund prices do vary from day to day and month to month. A fund’s standard deviation is one way to measure changes in price over time and can provide valuable information about volatility and risk. About 95% of the time you would expect the return to be between 2% and 18% (or 2 standard deviations on either side of 10%).

Is there any difference between mean deviation and standard deviation?

Alpha is defined as the excess return of the mutual fund over the benchmark return, on a risk-adjusted basis. Likewise, while beta gives us a perspective of the relative riskiness of an asset, it does not give us the absolute or the inherent risk of the asset itself. Thus, I can use R-squared numbers in conjunction with other statistical measures to help weed out redundant holdings. Such funds invest only in indices like the S&P 500 (United States) or Nifty 50 (India) stocks. R-squared measures the explained movement of a fund or security in relation to a benchmark.

Is Columbia Dividend Income A (LBSAX) a Strong Mutual Fund Pick … – Nasdaq

Is Columbia Dividend Income A (LBSAX) a Strong Mutual Fund Pick ….

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

Many portfolios do not display this tendency, and hedge funds especially tend to be skewed in one direction or another. R-squared investing is also an excellent diversification measure and is a part of my stock diversification strategy. A good diversification need not be only industry specific but statistics can also help. Unlike what some beginners believe, it is not a measure of portfolio performance. It is simply a measure of the correlation of the portfolio’s returns to the benchmark’s returns.

The fund is rewarded if the returns are generated by keeping a low-risk profile and penalized for being volatile. Beta is not an indicator of the inherent risk of the stock or MF. Lastly, if the beta of the fund is higher than 1, it implies that the fund is risker compared to its benchmark.

Understanding Standard Deviation

So, on a 3-year evaluation, the alpha for the Franklin India Bluechip fund is -4.65. Please visit FINRA’s BrokerCheck for specific state securities licensing for each Financial Advisor. This Website is informational purposes and is not an offer or solicitation of an offer to buy or sell any securities, products or services. Securities, products and services are offered through Robert W. Baird & Co. The standard deviation, on the other hand, would be the square root of the variance.

As a result, the alpha for this large cap fund make a very different reading. The alpha is the difference between the returns of your portfolio and the returns of the benchmark – which means the alpha can be positive or negative. A positive alpha of one means the portfolio has outperformed the benchmark by 1 percent. Likewise, a negative alpha indicates the underperformance of an investment.

Why Standard Deviation Matters When Choosing Investments

Though the standard deviation is an important measurement for mutual fund-related investment decisions, still like every other metric, standard deviation also has certain limitations. Markets are volatile, and equities are volatile, mutual funds are volatile; this is the very nature of markets. So if you can’t fathom watching your investment see-saw between gains and loss, then perhaps you should reconsider your investment decision in equities. We defined alpha as the excess return of the fund over and above the benchmark returns. Well, that is true, but we need to make a few small changes to that equation and include our newly introduced friend, beta. To understand alpha, we need to understand the concept of ‘Risk-free’ return.

- If the beta of a mutual fund is less than 1, then the fund is perceived as less risky compared to its benchmark.

- A stock with a beta of 2 (relative to the index) goes up or down twice as much as the index in a given period of time.

- An R-squared measure of 30 means that only 30% of the portfolio’s movements are aligned to the benchmark index movements.

- For investing purposes, you can think of standard deviation as simply a volatility metric.

- We can see this in the below chart where the fund has fewer proportion of it’s investments in financial stocks as compared to the benchmark.

By now, you should guess that since the beta is high, the fund gets penalised for its erratic behaviour. If the only information available is that the Sharpe ratio of a fund is 1.2, no meaningful inference can be drawn as nothing is known about the peer group what is standard deviation in mutual fund performance. The Sharpe ratio treats all volatility equal and thus penalizes approaches which have upside volatility leading to big positive gains in performance. Try a similar approach with Fund B where the mean is 100 and one standard deviation is 8.31.

As a consequence, more and more investors are switching to low-cost, passively managed Index funds with the rationale being, “if you can’t beat them, join them”. Standard deviation is a statistical measurement that shows how much variation there is from the arithmetic mean (simple average). Investors describe standard deviation as the volatility of past mutual fund returns. This measurement of average variance has a prominent place in many fields related to statistics, economics, accounting, and finance. For a given data set, standard deviation measures how spread out the numbers are from an average value. In case of mutual funds, you can compare the Sharpe ratio of a fund with its benchmark index to get a better understanding of excess return and mutual fund risk.

In statistics, the standard deviation measures the amount of variation for a set of data. For mutual funds, the standard deviation measures the variation of returns against a market index or another fund. The higher the variation, the higher the risk of investing in the fund. Assuming a normal distribution of returns, about 68% of Fund A’s returns will fall within plus or minus one standard deviation of the average (10%). About 95% of its returns will fall within plus or minus two standard deviations. In theory, that means about 68% of the time our example mutual fund will have returns between 0% and 20%.